Category Insights & Outlook 2023

Temporary labour

Temporary labour is a key tool for businesses to fill skill and capacity gaps in their organisations, as well as being a strategic vehicle for cost management and quality improvements. While generally more expensive on a unit basis, temporary labour can be used strategically to manage labour costs.

The category is increasingly affected by global shifts, such as regulatory change and movements in political and economic power. This can drive up costs of temporary labour, whether by contractors, agency labour or outsourcing1 making this an important category for businesses to address.

For a holistic view, the wider labour market is factored into the below analysis, as changes in temporary labour often respond to developments in permanent recruitment.

Read more

Other Categories

Trends to date

Temporary labour market

+17% increase

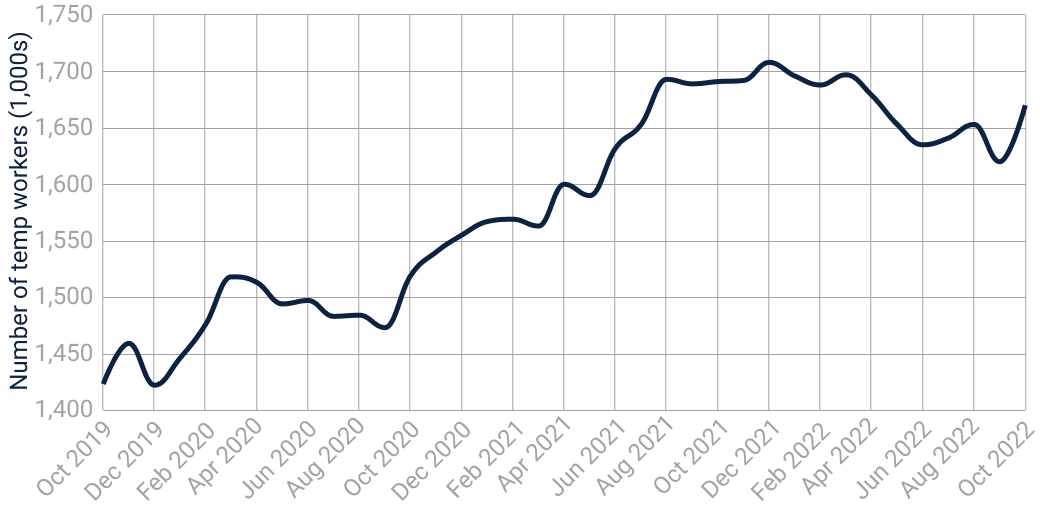

We have seen steady growth in the size of the UK temporary labour market for the last three years with numbers growing from 1.4m to 1.7m temporary workers, representing a c.17% increase.

In particular we have seen growing demand in sectors such as healthcare, education, and logistics.

Number of temporary workers in the UK

Source: ONS - Number of temporary workers in the United Kingdom from May 1992 to October 2022 (in 1,000s)

Economic and regulatory

Cost reduction focus and strikes have sustained demand for temporary labour and outsourcing.

- In an environment of increasing cost pressures, a recent survey has shown that 88% of companies note cost reduction as an objective for outsourcing2, thus sustaining demand for outsourcing to low-cost locations.

- As of July 2022, in the UK, businesses are able to hire agency workers to cover for striking workers, creating short-term demand for temporary labour.

Social changes

There has been increased demand for outsourcing and temporary labour following the pandemic.

- In the aftermath of the pandemic, remote working and global teams became more commonplace, sustaining the popularity of outsourcing and gig workers including temporary labour.

- We also see companies moving from a “just-in-time” supply chain model to “just-in-case”. This – in addition to common language, time zones and cost-effectiveness – has contributed to a rise in nearshoring (use of outsourcing services closer to home), including Eastern European locations for UK companies, in lieu of traditional locations in India and China.

Worker shortages

There are cross-sector worker shortages, which are likely to have an impact in 2023 and beyond.

- The global labour market has been stagnating, with the International Labour Organisation (ILO) reporting a 1.5% reduction in the number of hours worked between Q4 2019 and Q3 2022. This represents a deficit of around 40 million full time jobs3.

- Changes in migratory patterns, in part due to the pandemic and Brexit, have created a squeeze in temporary labour in specific areas, including lorry drivers, fruit pickers, poultry workers and farm workers.

- There has been a labour shortage in IT outsourcing, in part due to the disruption of ~100,000 workers from the Russia-Ukraine war. However, due to an overinvestment in tech during the lockdown and falling advertising budgets ahead of an expected recession, large-scale technology layoffs, particularly in India, should alleviate the squeeze temporarily.

Future outlook

Short term outlook

Slowdown in growth of temporary labour

- We expect a slowdown of temporary labour demand due to increasing inflationary pressures and the economic slowdown. Temporary labour is often one of the first categories to be cut in economic downturns.

- On the normalisation of UK union-government relationships and a reduction of strikes, the use of temporary labour to cover worker gaps will reduce.

- More niche and qualified temporary labour tends to be largely shielded from changes in the economy, including back office roles and temporary senior positions, for example, CFO, CPO, and Financial Controller.

Continued worker shortage squeeze

- Worker shortages, particularly in the technology market and as a result of the Ukraine crisis, will create upward pressure on wages and thus create downward pressure on the demand for labour. In 2023, according to WTW, the UK is predicted to increase average salaries by 5%4.

- We expect that this will be partly mitigated by slower growth in temporary labour and the increase in layoffs in technology – particularly in India – providing temporary availability of resources.

Changes in temporary labour and outsourcing patterns

- We expect nearshoring to continue to rise in popularity, for instance in Eastern Europe for UK companies.

- We anticipate more labour to become available from Eastern Europe, particularly in Romania, Poland, and Belarus. Having said this, there is still considerable uncertainty as the Russia-Ukraine war persists.

Medium term outlook

Regulatory uncertainty

- Depending on the length, severity, and public sentiment of the cost of living crisis, governments may respond with increased minimum and public sector wages thus applying pressure on labour markets, including temporary labour.

Temporary labour market recovery

- Further on the horizon, as the economy recovers, our expectation is an increased demand for temporary labour as firms utilise it in their recovery strategy.

Dos, Don'ts, and Best Practices

Dos:

Expand to learn more about what should be done.

- Evaluate your location risk – such as direct or indirect exposure to Ukraine, Belarus, or Russia.

- Assess your track record with attrition and analyse root causes (salary, work mix, model).

- Put it back on your supplier to propose cost reduction ideas (for example, adjusting location).

- Adjust your supplier mix to leverage different locations (in-house or external).

- Consider adding low-cost locations, leveraging the work from home momentum.

Don'ts:

Expand to learn more about what shouldn't be done.

- Don’t react or rush for short-term need (for example, in signing up for rates).

- Don’t put all your eggs in a single basket – leverage diversification (for example, supplier, location).

- Don’t be only mechanical or demanding; try to build long-term partnerships, making you an interesting client / employer.

- Do not be over-prescriptive but aim at the output while being flexible in the “how”.

best practices:

Expand to learn more about best practices.

- Build a strategy: Assess cost exposure and future options (talent pools) on a granular level (for example, region, role types); attrition challenges and growth) – consider using a mix of regional/global suppliers.

- Assess process maturity and readiness to impact the location mix of your workforce – leverage your workforce’s experience with work from home to reassess the situation.

- Build a mix of paths to talent (in-house/regional/global) leveraging benefits (flexibility/loyalty) to best serve your needs.

Key takeaways

- Plan for expected disruption in temporary labour markets in terms of availability of staff and location.

- Budget for an increase in costs despite an expected fall in demand due to upward pressure on wages.

- Evaluate, whether or not short-term cost savings are required and if savings can be made in temporary labour reductions.

- Consider nearshoring options and new outsourcing locations as they become more popular.

Read more

Other Categories

Contact us

How Efficio can help

If your business is or has been impacted by any of these trends, or you would like to dive deeper into the outlook and associated guidance for any of the above categories, our SMEs are available to help.

Contact us