Category Insights & Outlook 2023

Energy

Energy is a major cost driver for industries, from manufacturing to logistics. It is an area that has seen significant volatility and has been impacted by sharp rises in the last few years.

Despite the uncertainty and volatility, actions can still be taken to help minimise the impact on the wider company. This has become even more important given that we do not expect stabilisation or improvement in the short to medium term.

Read more

Other Categories

Trends to date

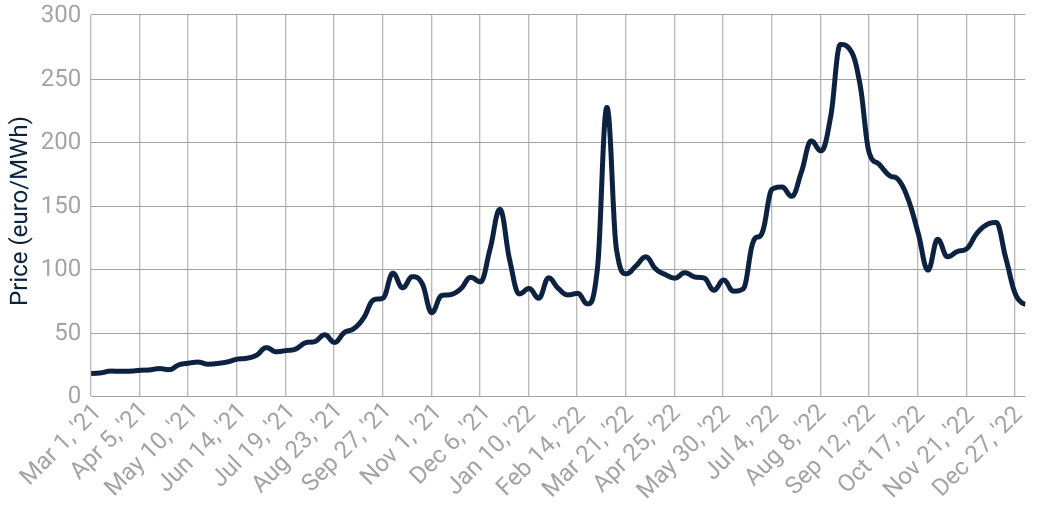

- The key driver for the sharp rise in gas prices since winter 2021 is the limited gas supply across Europe.

- Gas storage levels were significantly below expected because of the cold spring in 2021, despite a milder winter in Europe.

- The Nord Stream 2 pipeline that was planned to come online did not materialise.

- Asian LNG prices rose due to high demand, which in turn drove Europe gas prices up to attract more LNG deliveries to meet high demand during the cold winter.

- The Russia-Ukraine conflict worsened the situation, given Europe imported 45% of its gas from Russia in 2021.

TTF Gas price 2023 futures from March 2021 until January 20231

1 Sources: Statista Dutch TTF Gas Futures at the Beginning of Each Week (Jan 4 2021 to Jan 9 2023) | Investing Dutch TTF Natural Gas Futures - Nov 22 (TFAc1)

The above events lead to us ask:

- Are we seeing complacency in Europe? While gas storage appears to be full, we need to bear in mind that Russian supply only ended in the summer, and a warm summer and warm winter played in our favour in terms of consumption.

- Will wholesale energy market prices go up again at the start of this year? While prices are currently low (in the context of recent history), as storage reserves deplete and resources are in high demand, price volatility is likely to return.

- Even if we see gas prices fall, will electricity prices follow to the same extent? Not necessarily. Electricity prices are subject to cross-border constraints and resilience concerns due to the increased use of renewable assets.

Future outlook

Energy price inflation in Europe was at 42% in October 2022. Energy prices have fallen significantly since then but it is highly unlikely that we will return to pre-war prices in the short to medium term.

Short term outlook

- Government intervention - The introduction of the TTF cap of €180 per MWh across the EU may not have the impact the EU commission desires if the market does move above this cap. Therefore, this figure should not be relied upon when constructing budgets.

- Rise in prices - The size of the increase will be dependent on short-term easing of prices, how cold the remainder of this winter is and, consequently, the storage levels of energy at the end of the period. Currently, we a see significant softening of prices at the TTF due to warm weather and economic headwinds; however this may change.

- Increase in the use of energy brokers and PPAs - We expect a demand increase for the longer-term and/or alternative type contracts in the energy sector. We recommend that gas and electricity be considered together as a combined risk, so if one is hedged this needs to be factored into how much volume of the other commodity is hedged so that risks aren’t inadvertently increased.

- Focus on efficiency and technology - We expect a growing focus on energy efficiency, both from user and supplier perspectives, to help improve consumption and predict demand by leveraging new technologies.

- Energy shortages - Expected occurrence of energy shortages will trigger companies to have contingency plans in place to mitigate risk.

Medium term outlook

- Government intervention and cross border cooperation - Continued government interventions are likely to result in price uncertainty and short-term demand, which is likely to trigger cross-border power trades within Europe and significant investments into transmission systems.

- Passing of energy costs - With expected ongoing challenges, we encourage companies to explore inclusion of energy into purchasing contracts and reserve the right to pass through costs in case of significant increase.

- Rise in demand for renewable energy - We do not expect significant impact from COP27. However, in light of the scarcity and cost of current energy sources, there is an increased need to use renewable sources despite challenges associated with deploying them (for example, intermittency, dispatchability, and storage).

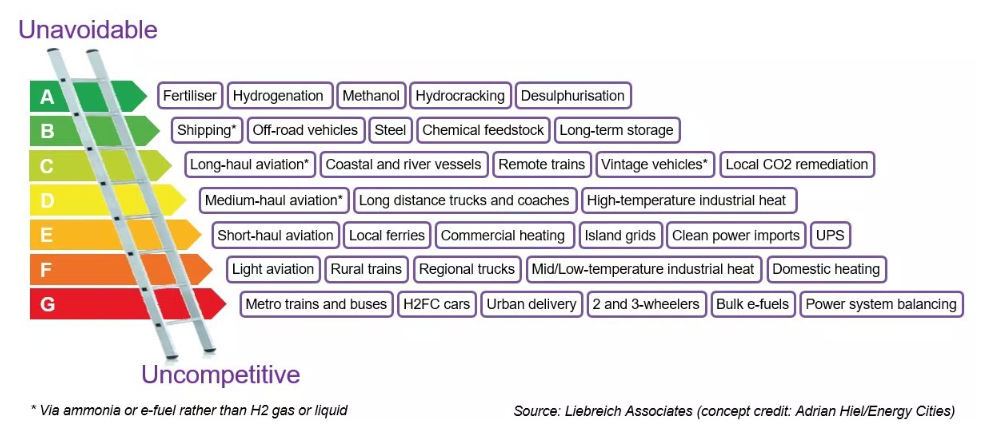

- Focus on hydrogen and nuclear- Nuclear energy is likely to be less reliable as a base load source in the short to medium term, due to current policies, reactor maintenance, and supply crisis in Europe. Hydrogen could be a viable solution in the long term but there are new challenges around the energy requirement of its round-trip processing (as shown below).

Clean Hydrogen Ladder

2 Source: Michael Liebreich/Liebreich Associates, Clean Hydrogen Ladder, Version 4.1, 2021. Concept credit: Adrian Hiel, Energy Cities. CC-BY 3.0

Dos, Don'ts, and Best Practices

Dos:

Expand to learn more about what should be done.

- Have a supply contract in place; there is operational and price risk at stake.

- Seek flexible supply contracts; this allows management of extreme volatility over the long term.

- Ensure resources are available to keep business informed of risks.

- Market information is key to managing expectations, budgets, and forecasts.

- Take time to assess the impact of inflation / volatility / shortages on spend and margins.

Don'ts:

Expand to learn more about what shouldn't be done.

- Do not sign fixed price contracts without a good reason and without exhausting alternatives.

- Do not manage market risk without robust risk management policy and buy in from key stakeholders.

- Do not forget to assess other implications of pricing and availability, whether for ESG or for the wider supply chain.

- Do not accept increases – review and use escalation process to assure that they are justified.

- Do not assume that 100% renewable energy will be automatically available.

-

best practices:

Expand to learn more about best practices.

- Understand the amount of budget you are willing to stake and stick rigorously to it (including Stop Losses); you are managing risk not running a proprietary trading business:

- If you hedge now and competitors don’t and the market collapses, what is the material impact on revenue/margins?

- If you don’t hedge now and price reverts to recent highs, what is the material impact?

- Price risk doesn't exist if you pass it through – ensure client contracts have relevant clauses (price index).

- Consider how risk works in each national energy market and hedge accordingly (winter holds more volatility and risk than summer).

To accelerate results and delivery, businesses need the right team with a full understanding of requirements. We understand this can be a challenge. Not all organisations have the capacity to operate an end-to-end procurement function or the time to train their people.

As both consultants and practitioners, we’ll turbo boost your delivery and results using a combination of knowledge, technology, content, and data. Whether that’s training through the Efficio Academy, accessing our eFlow Knowledge Hub, or using our data to drive decision making, you will successfully boost your procurement function in the long and short term.

Key takeaways

- Hedge electricity and gas in a joined-up approach – they are highly correlated.

- Be smart with hedging strategies and leveraging PPAs.

- Focus on identifying efficiencies and, where possible, bringing in renewables.

- Have contingency planning in place in case of power shortages and blackouts (energy on risk register).

- Incorporate energy references and reserve rights in purchasing contracts.

Read more

Other Categories

Contact us

How Efficio can help

If your business is or has been impacted by any of these trends, or you would like to dive deeper into the outlook and associated guidance for any of the above categories, our SMEs are available to help.

Contact us