Category Insights & Outlook 2023

Metals

The metals market remains highly volatile in the face of multiple macroeconomic pressures. On the supply side, multiple geopolitical issues and natural disasters have disturbed supply chain logistics.

On the demand side, widely incorporated ESG practices have affected the manufacturing industry, and potential economic recessions could lower consumer demand and therefore impact the demand for metal from Manufacturing.

Read more

Other Categories

Trends to date

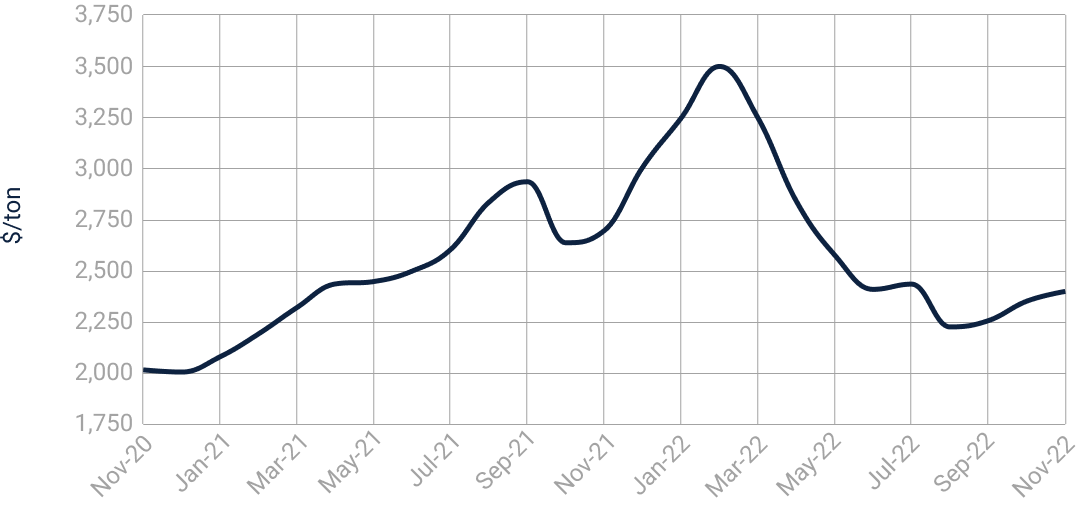

Steel

-15% YoY change (Jan 2022-Jan 2023)

Prices have fallen significantly following a steep rise at the beginning of 2022. The early 2022 price rise was a result of the Russia-Ukraine conflict disrupting the supply of material for steel production. However, as European countries have headed into recession, prices dropped with reduced demand from construction.

Price of Steel

Source: "LME-STEEL HRC FOB CN ARGUS CONT - SETT. PRICE." from Refinitiv Eikon for the period Jan 2021 through Jan 2023

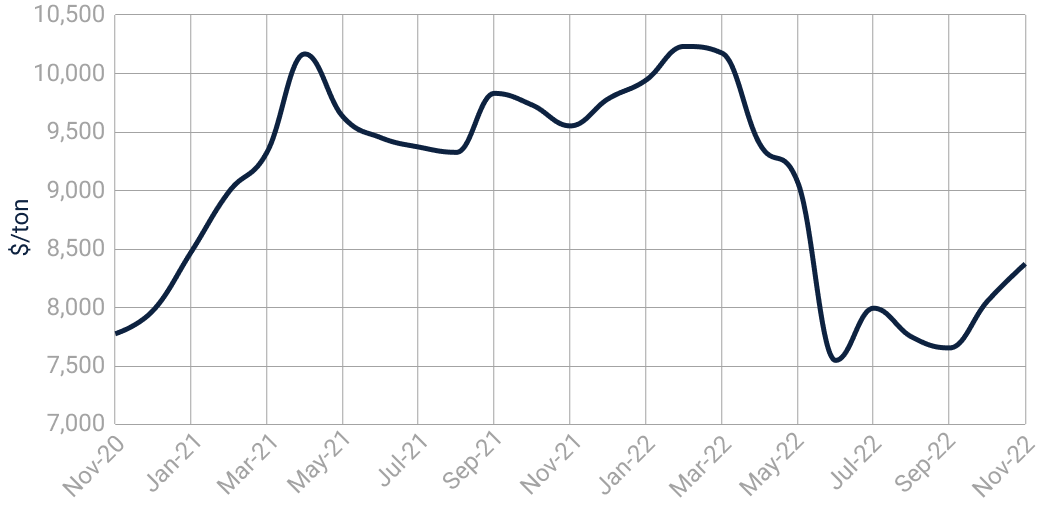

Aluminium

-10.8% YoY change (Nov 2021-Nov 2022)

Prices dropped at the beginning of 2022 and stayed low throughout the year, as exports to Russia (60% of the consumption) were banned and consumption from the automotive industry dropped (stoppages due to shortage of semiconductors1,2). Prices have recently (Q4 2022) soared due to the fluctuation of energy prices induced by geo-political forces since production of aluminium is a highly energy-intensive process.

1) Strategy Analytics 2022 - EV Semiconductor Demand Outlook 2021-2029;

2) Bloomberg 2022 - ASML’s Factory Fire May Have Hit Output of Key Chip Machines;

Price of Aluminium

Source: "Aluminum, 99.5% minimum purity, LME spot price, CIF UK ports" from International Monetary Fund for the period Nov 2020 through Nov 2022

Copper

-17.3% YoY change (Nov 2021-Nov 2022)

Throughout 2022, Copper prices stayed low and did not increase compared to the energy metals index. This was because demand from the major driver of copper consumption – production of electric components – was limited due to the semiconductor crisis1,2.

1) Strategy Analytics 2022 - EV Semiconductor Demand Outlook 2021-2029;

2) Bloomberg 2022 - ASML’s Factory Fire May Have Hit Output of Key Chip Machines;

Price of Copper

Source: "Copper, grade A cathode, LME spot price, CIF European ports" from International Monetary Fund for the period Nov 2020 through Nov 2022

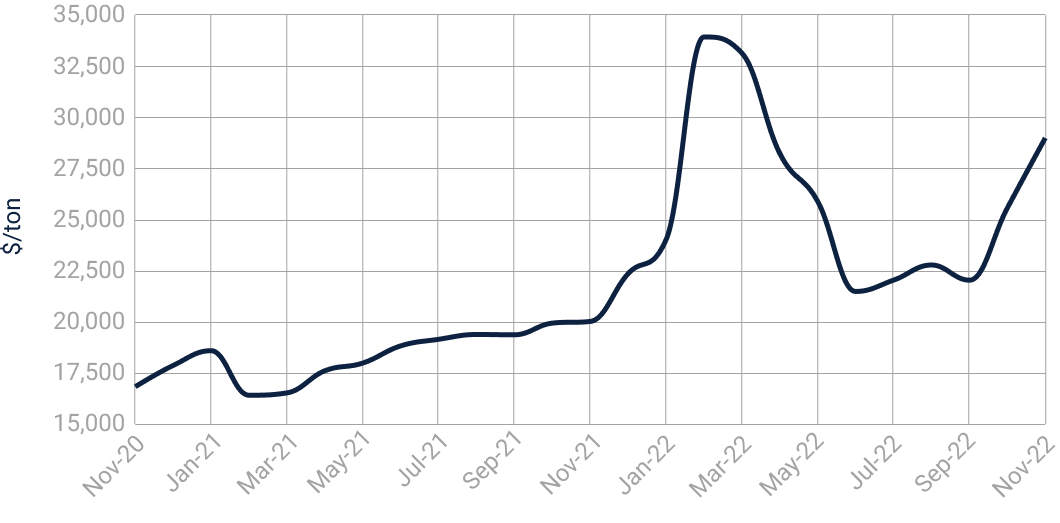

Nickel

+28.2% YoY change (Nov 2021-Nov 2022)

In the beginning of 2022, Nickel prices skyrocketed with the onset of the Russia-Ukraine conflict that halted trade. However, prices fell as the supply shortage was compensated by a rapid increase of Indonesian production, which increased by 41%3.

Furthermore, through Q3-Q4 of 2022, prices were maintained as the demand dropped with new health restrictions and closure of manufacturing facilities in China, the largest nickel consumer.

3) Reuters 2022 - Indonesia's nickel surge bad news for price and pricing;

Price of Nickel

Source: "Nickel, melting grade, LME spot price, CIF European ports" from International Monetary Fund for the period Nov 2020 through Nov 2022

Tin

-45.7% YoY change (Nov 2021-Nov 2022)

Prices were steadily increasing until the end of Q1 2022, as consumption is linked to demand for soldering electronics and coating cables in 5G telecom networks. The prices started falling in Q2 2022, as demand fell due to shrinking production in China (key region) from new COVID-19 outbreaks.

Price of Tin

Source: "Tin, standard grade, LME spot price" from International Monetary Fund for the period Nov 2020 through Nov 2022

Cobalt

-14.7% YoY change (Nov 2021-Nov 2022)

Like Nickel, demand for Cobalt has increased due to Electric Vehicles (EVs) and battery production, contributing to soaring prices until Q2 2022. Since cobalt is a by-product of mining Nickel and Copper, the supply was affected by the Russia-Ukraine conflict.

However, growth in production (26%) in Congo (50% of production) combined with lower demand from China, due to renewed restrictions, led to a decrease in prices4.

4) ScienceDirect: One hundred years of cobalt production in the Democratic Republic of the Congo

Price of Cobalt

Source: "Cobalt, minimum 99.80% purity, LME spot price" from International Monetary Fund for the period Nov 2020 through Nov 2022

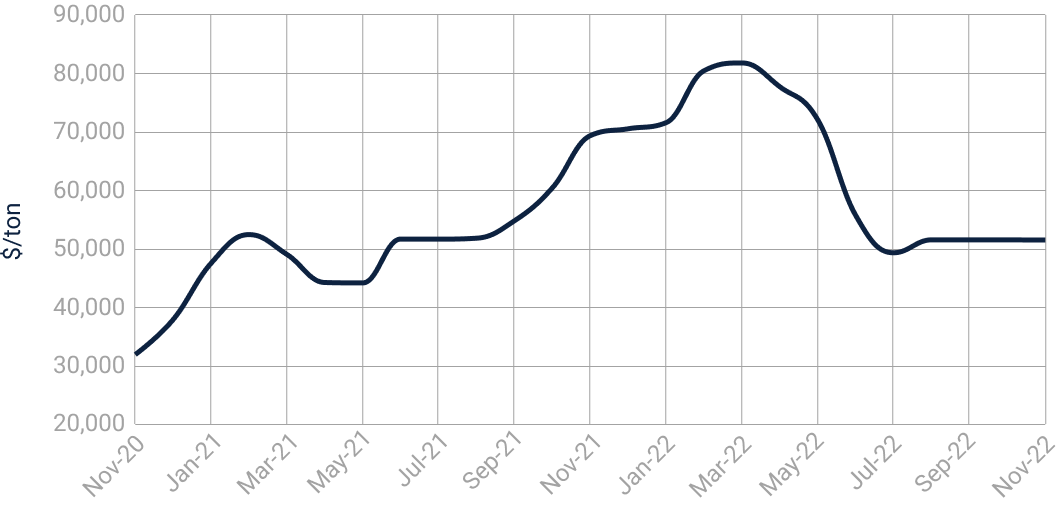

Lithium

+150.6% YoY change (Nov 2021-Nov 2022)

Lithium’s skyrocketing prices at the beginning of 2022 were mainly due to elevated demand from the previously mentioned EV and batteries surge and further exacerbated by a shortage of supply due to low mining capacity and high effort to scale the complex mining process5.

Price of Lithium

Source: "Lithium, 99% pure, industrial grade, battery grade" from International Monetary Fund for the period Nov 2020 through Nov 2022

Future outlook

With inflation for base metals hitting -19% in August 2022, it is anticipated that the downward trend will continue into 2023, reaching an expected -12%, according to the International Monetary Fund.

Short term outlook

- Aluminium prices will stabilise as Europe responds to the energy crisis, with the aim of a 15% reduction in industrial natural gas usage by Q3/Q4 2023. This is likely to be achieved by the lowering of industrial activity and a slowdown of primary Aluminium consumption.

- It is expected that the price of Copper will increase and return to the pre-COVID-19-pandemic growth trend. This is likely due to reinforced health restrictions in China as well as limiting supply while the consumption of this metal continues to grow.

- These continued restrictions will likely also impact Tin prices, leading to their decrease due to reduced demand.

- Steel and Cobalt prices will be impacted by the recession in Europe and the associated decrease in consumption of end-products and reduction of construction projects.

Medium term

- We expect prices for Aluminium to decrease once China overcomes the COVID-19 pandemic outbreak, and the supply will normalise, reducing a supply shortage.

- It is likely that prices for Nickel will stabilise and potentially decrease in the mid-term as any increase in demand from resumed production in China, and a surge in demand for batteries will be mitigated by capacity expansion projects in Indonesia.

- Tin prices are likely to continue to fall as factories in Malaysia are expanding their production, meeting the growing demand from solar panels production and 5G rollout.

- We predict that Copper prices are likely to go down as new mining facilities are planned to be opened in Congo and Peru, and two mines in Chile are boosting their production6, meeting the growing demand from a recovering world economy, the surge of electric vehicles (EVs), and infrastructure development.

- We estimate that prices for Lithium and Cobalt will stabilise as the upward trend in demand will continue for various batteries and energy storage systems. This increased demand is anticipated following recovery from recession and the overcoming of supply shortages from China, with supply contracts secured in Australia and South America.

Dos, Don'ts, and Best Practices

Dos:

Expand to learn more about what should be done.

- Consider renegotiating prices for certain metals.

- Run an impact assessment and estimate exposure and dependencies.

- Prioritise initial supply continuity and consider inventory / planning levers.

- Look for alternative suppliers (new locations) to limit exposure.

- Treat this as an opportunity to optimise, reduce, and innovate.

- Pass through costs where possible.

Don'ts:

Expand to learn more about what shouldn't be done.

- Do not accept increases; determine if they are justified, and agree on the conditions for accepting them.

- Do not rush – assess risks, opportunities, and create short-, medium-, and long-term strategies.

- Do not treat the category in silo; see it as part of total spend basket.

- Do not think you can't break a contract – breaking and paying a penalty can be better.

best practices:

Expand to learn more about best practices.

READINESS

- Understand the price breakdown:

- Create full transparency across your procurement costs and supply chain impacts.

- Arrive at a position where "should cost" analysis can be performed.

SHORT TERM

- Ensure supply and prepare mitigation:

- Confirm exposure and priorities.

- Ensure supply.

- Thoroughly prepare for negotiations with business-critical supply partners.

LONG TERM

- Manage volatility impact and boost resilience:

- Review long-term procurement strategy.

- Ensure the right capabilities.

- Explore risk management strategies.

Key takeaways

- Renegotiate pricing with the key suppliers as the prices for several metals will be going down.

- Negotiate longer term contracts with suppliers to mitigate future supply shortages.

- Consider restructuring the supply base by going regional or exploring suppliers in the regions with expanding production capacities that will reduce total cost and improve supply chain agility.

Read more

Other Categories

Contact us

How Efficio can help

If your business is or has been impacted by any of these trends, or you would like to dive deeper into the outlook and associated guidance for any of the above categories, our SMEs are available to help.

Contact us