Category Insights & Outlook 2023

Logistics

Disruptions in international logistics combined with challenges in global supply chains generated huge imbalances that branch into all parts of the economy and geopolitical issues.

Despite improvements in the latter half of 2022, the equilibrium in the flow of vessels and containers is yet to be fully restored to facilitate consumer demand and is a key contributor to the inflated cost of goods.

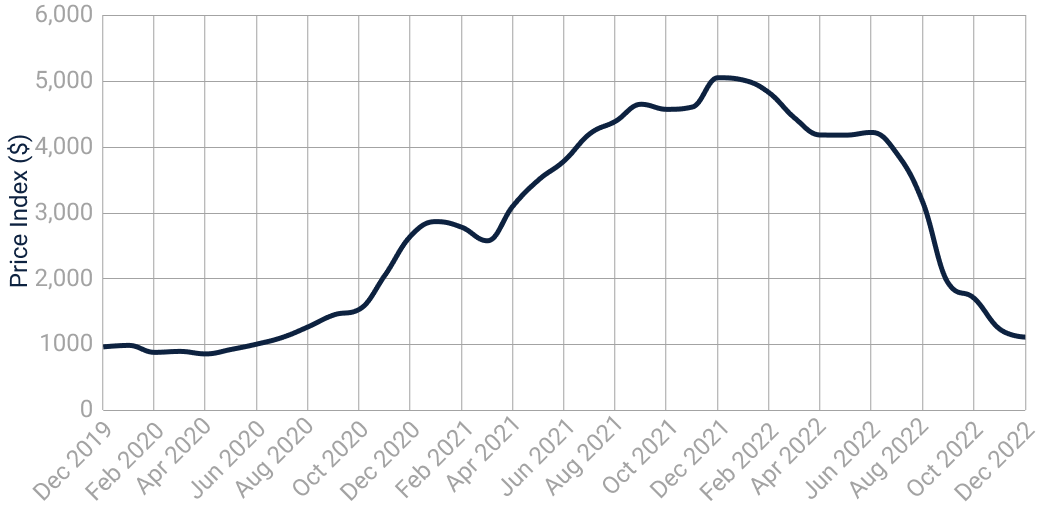

Following drastic price increases for ocean freight containers in 2021 and 2022, rates have fallen below the expected level that experts predicted for Q4 2022 and Q1 2023.

Air freight capacity has increased due to shippers moving back to more affordable ocean freight transport and airlines reintroducing more services as air travel returns to normality.

Cost of fuel remains elevated entering 2023 as the Russia-Ukraine conflict continues to impact the cost of fuel globally and is applicable to all modes of transport.

Read more

Other Categories

Trends to date

Ocean freight

Shippers have been subjected to paying high prices with low service levels, disrupting global supply chains across all industries for the past two years.

High volume cargo owners resorted to chartering vessels to minimise disruptions in their supply chains.

Fewer containers moving from Asia to Europe have contributed to a 30-40% price drop since January 2022.

Shanghai Containerized Freight Index (SCFI) 2020 - 2022

Air freight

Airlines benefitted from the rise in e-commerce during and post-COVID-19 pandemic, but they faced capacity challenges as cargo owners shifted their strategies to air freight due to challenges in other modes of transport.

Despite capacity freeing up in the second half of 2022, global jet fuel prices sit at a 10-year high.

Price of Jet Fuel 2014 - 2022

Road freight

To combat the energy crisis, some countries in Europe (such as Germany and Poland) have given rail priority to shipments of coal and fuel, adding an extra burden on road transport being the main alternative.

Large driver shortages across Europe and the US remain; the International Road Transport Union is continuing to work on removing barriers to entry, improving working conditions and increasing automation to resolve the crisis.

Ti, Upply & IRU European Road Freight Rate Development Benchmark 2017 - 2022

Future outlook

Inflation across different categories will reduce imports as buying patterns change to more cost-effective or alternative options. This is likely to lead to softer demands for logistics services.

Short term outlook

- IMO 2023 – The introduction of the IMO (International Maritime Organisation) 2023 surcharge from 1 January 2023 will require shippers to pay a surcharge on top of all ocean freight rates to offset new regulations imposed on ship owners to promote more sustainable transport. While we do not expect the same impact as IMO 2020, shippers will expect an increase in their costs.

- Fluctuating spot market – With significant volatility in the freight markets, there will be opportunities for customers who have high risk tolerance to take advantage of market changes that are in their favour. We suggest that our clients reserve some shipping for the spot market and not lock all known cargo into contracts after detailed analysis.

- Fuel escalation – As the cost of fuel is intrinsically linked to geopolitical issues and reflected in the cost of transport, customers should ensure that fuel mechanisms in their contracts are fair and linked to a trusted index.

- Driver shortages – As a generational challenge, there is no immediate resolution to bringing more drivers in to facilitate the demand. We expect to see further delays as logistics companies continue to combat labour shortages.

- Influx of new vessels in the ocean – A combination of record profits for carriers, demand for more equipment, and scrappage of older less sustainable vessels saw huge investments in new vessels. We expect to see these arrive in 2023/2024, adding further capacity to the market.

Medium term

- Environmental regulations and sustainability – Emphasis on greener supply chains will continue to grow as companies approach their target net zero dates. Governments are introducing clean air or low emission zones in cities to enforce more parameters to logistics companies.

- Technology – We expect to see continued investments in technology to help firms on supply chain visibility; for example, focus on track and trace systems to improve agile decision making when challenges arise.

- Final mile deliveries – With the boom in e-commerce, innovative solutions will be explored to meet consumer delivery demands. We expect to see more popularity in the usage of drones and e-vehicles to manage final mile deliveries.

Dos, Don'ts, and Best Practices

Dos:

Expand to learn more about what should be done.

- Have transparency over planned transports, capacities, and relevant routes.

- Create strategic relationships; join an alliance to secure capacities.

- Pass through transport costs to customers.

- Optimise fill rates; reduce impact on Cost of Goods Sold (COGS).

- Run an impact assessment, understand your spend/budget, and estimate exposure.

- Tender for road freight (post analysis).

Don'ts:

Expand to learn more about what shouldn't be done.

- Do not rely on old and outdated information without monitoring news and trends.

- Do not source all capacities on the spot market without strategic relationships.

- Do not give all volumes to one freight forwarder.

- Do not accept price increases from freight forwarders “as is” – there is ample room for negotiation.

best practices:

Expand to learn more about best practices.

Secure logistics capacity

- Add flexibility to handle volatility.

Cost management

- Optimise transport nodes on total cost comparison.

- Check the financial viability of suppliers.

- Get transparency of cost drivers.

- Audit invoices for surcharges and discrepancies.

Distribution network design

- Flex network design as patterns change.

- Review supply chain nodes.

Key takeaways

- Stay proactive and respond strategically to an unpredictable market, and continuously review reactive decisions from previous years as the market has shifted to look for opportunities in cost savings.

- Optimise transport flows and invest in technology that supports approaching net zero targets.

Read more

Other Categories

Contact us

How Efficio can help

If your business is or has been impacted by any of these trends, or you would like to dive deeper into the outlook and associated guidance for any of the above categories, our SMEs are available to help.

Contact us