The ground is shifting quickly beneath pharma and healthcare supply chains as we enter 2026. Patent cliffs, policy reforms, and technological disruptions are kicking in as geopolitical pressures reshape supply bases and patient demographics shift. For procurement teams, decisions and actions over the next year will have an outsized impact on cost and margins, as well as innovation, resilience, and patient care.

Trends and actions for pharmaceutical procurement

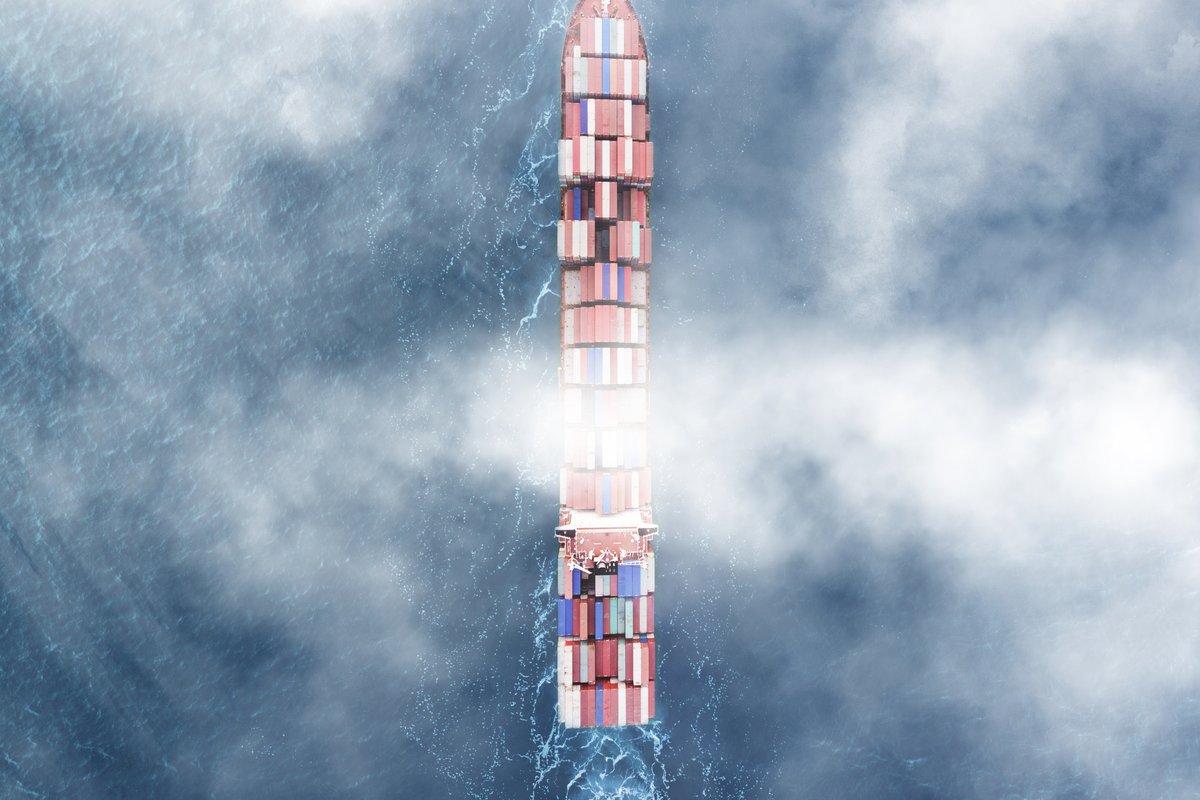

1. Geopolitical instability and the push for hybrid supply chains

The global trade environment remains volatile, with inconsistent US tariff policies making long-term supply chain planning increasingly difficult. In response, many pharmaceutical companies are diversifying their manufacturing and API supply bases, expanding operations in India and Southeast Asia to capitalise on cost advantages while managing resilience risks.

Concurrently, governments across the globe are accelerating localisation agendas. In the US, trade policy is nudging manufacturers toward reshoring, supported by measures like the Most Favored Nation (MFN) pricing model. The EU Critical Medicines Act and Saudi Arabia’s National Biotechnology Strategy demonstrate similar ambitions to reduce foreign dependency and safeguard national healthcare sovereignty.

These parallel trends of global diversification and regional localisation create a complex, often conflicting, set of priorities, with procurement and supply chain leaders tasked with designing hybrid operating models. These must balance cost efficiency with supply security, often through dual sourcing, nearshoring, and scenario-based geopolitical risk planning.

Recommended actions for procurement leaders:

Build multi-tier supply visibility and adopt event-triggered risk monitoring for geopolitical shocks.

Segment products by criticality to determine which require domestic or nearshore supply and which can remain globally sourced.

Develop financial and operational models that quantify the trade-offs between resilience, cost, and regulatory compliance.

Strengthen relationships with strategic suppliers across regions to enable flexible manufacturing allocation.

2. The 2026 patent cliff and the race to rebuild pipelines

The patent cliff looms large as several blockbuster drugs lose exclusivity between 2025 and 2028. Facing inevitable revenue erosion, leading firms are pursuing M&A, licensing deals, and partnerships to accelerate access to novel therapies. At the same time, internal cost pressures are intensifying as companies invest heavily in biologics, cell and gene therapies, and personalised medicine.

Procurement and supply chain teams will play a key role as organisations integrate new acquisitions, harmonise supplier ecosystems, and strengthen capabilities to support increasingly complex manufacturing networks.

Recommended actions for procurement leaders:

Drive post-merger integration by rapidly rationalising suppliers, consolidating spend, and aligning quality and compliance processes.

Build innovation-sourcing capabilities, partnering with R&D to identify emerging biotech and CDMO suppliers early.

Strengthen category strategies in biologics and advanced therapies, where supply constraints and technical complexity are rising.

Use total cost of ownership (TCO) models to prioritise value creation over unit-price optimisation.

3. The redefinition of clinical development by AI-powered CROs

Contract Research Organisations (CROs) are rapidly integrating AI into clinical trial design, patient recruitment, site selection, and data management. These capabilities promise shorter timelines, lower trial costs, and improved data quality, making AI-enabled CROs increasingly attractive partners for pharma firms navigating rising R&D pressures.

However, the landscape is highly fragmented. Traditional CROs are racing to build or acquire AI capabilities, while niche AI-first players offer specialised platforms for modelling, feasibility assessments, and real-world data analytics. This creates new complexity for procurement: evaluating technical maturity, validating data integrity and regulatory compliance, and managing integration across multiple digital ecosystems.

Recommended actions for procurement leaders:

Develop evaluation criteria that assess CROs’ AI capabilities, including model transparency, data governance, and regulatory readiness.

Prioritise CRO partners that can integrate AI tools seamlessly with internal R&D and clinical systems.

Create flexible contract models that incentivise measurable efficiency gains from AI-driven processes.

Strengthen cross-functional alignment with Clinical, Regulatory, and Data Science teams to ensure AI-enabled solutions meet operational and compliance needs.

Trends and actions for healthcare procurement

1. Consolidation-led reshaping of the sector

Consolidation continues in the global healthcare sector. Private equity is leading a wave of mergers and acquisitions across hospital networks, clinics, and supplier ecosystems.

In the US, the government’s budget reconciliation law enacted by Congress in July 2025 is expected to reduce Medicaid spending by $911 billion over the next decade and put immense pressure on hospital networks, particularly rural and non-profit providers. Hospitals may close or consolidate as a result, reshaping regional care delivery and supplier demand patterns.

For procurement and supply chain functions, this consolidation creates both opportunity and complexity. Leaders must manage post-merger integration, harmonise supplier contracts, and capture synergies, all while maintaining supply continuity and compliance. Success will require acting as true architects of integration, using data and category insights to unify newly combined entities efficiently and strategically.

Recommended actions for procurement leaders:

Establish integration playbooks covering contract harmonisation, supplier rationalisation, and category strategy alignment.

Use spend analytics and clinical utilisation data to standardise products and drive evidence-based purchasing decisions.

Strengthen governance and value-based sourcing approaches across newly merged organisations.

Prioritise supply resilience and patient-critical categories during consolidation to avoid disruption.

2. The AI revolution and the new healthcare ecosystem

The explosion of AI-driven healthcare startups is transforming care delivery, data analysis, and technology sourcing. AI-based diagnostic tools, automated patient record analysis, and predictive scheduling platforms are reshaping supplier categories and core operational workflows.

Simultaneously, the shift toward at-home care and telehealth is decentralising service delivery. Home-based blood testing, remote allergy shots, and virtual chronic care management are reducing the utilisation of traditional care sites while demanding new procurement capabilities. Leaders must assess suppliers on factors such as cybersecurity, data privacy readiness, scalability, and clinical safety, particularly when engaging early-stage innovators.

As the sector moves beyond digitisation and cloud adoption to actively utilising data to improve care, procurement will increasingly be responsible for sourcing data platforms, analytics tools, and AI partnerships that support personalised care and operational efficiency.

Recommended actions for procurement leaders:

Develop a governance framework to evaluate AI suppliers for clinical robustness, data security, and regulatory readiness.

Expand category strategies to include home-based care devices, remote monitoring technologies, and digital therapeutics.

Build partnerships with innovation hubs and startups to anticipate emerging technologies.

Collaborate with IT and clinical teams to assess interoperability and clinical adoption risks.

3. A surge in senior care demand

Globally, ageing populations are reshaping healthcare needs, with a sharp rise in demand for long-term care, assisted living, and specialised geriatric services. Many health systems are expanding or redesigning senior care facilities to manage chronic illnesses, mobility limitations, and cognitive health challenges more effectively. This shift is also accelerating investment in home-based care and remote monitoring technologies that help seniors remain independent for longer.

For procurement, this demographic transition requires a rethinking of category strategies. Spend will shift toward assistive devices, chronic disease management tools, fall-prevention technologies, nutrition and wound care products, and specialised staffing or service partnerships. Supply chains must also adapt to new volume patterns, higher dependency on recurring consumables, and stringent safety and quality requirements for vulnerable populations.

Recommended actions for procurement leaders:

Build category strategies around senior-care-specific products and services, including durable medical equipment, remote monitoring tools, and chronic care supplies.

Strengthen supplier qualification processes to ensure reliability, patient safety, and regulatory compliance for geriatric populations.

Partner with clinical and operational leaders in senior care facilities to forecast demand patterns and standardise products.

Explore strategic partnerships with service providers offering in-facility and at-home senior care solutions to ensure scalable, cost-effective models.

From efficiency to strategic leadership

Procurement teams in pharma and healthcare must ready themselves for a tough year ahead. Cost discipline will need to be even more rigorous, but it will represent only one of the many challenges the function must navigate.

Tightening budgets will need to be balanced against the demands of increasingly complex clinical and manufacturing ecosystems, AI-enabled R&D, and shifting population needs. To stay ahead, leaders will have to make deliberate trade-offs and build supplier partnerships capable of absorbing real disruption.

Download the pdfHow we help

Explore how Efficio helps leading pharmaceutical companies and healthcare providers build procurement functions that are resilient, agile, and fit for long-term success.

Learn more